It looks like the following optimistic scenario. The optimistic scenario is that America will be able to shake off the remaining pandemic symptoms in the months ahead. Congress does not pass additional deficit-busting spending programs and allows the 2017 tax cuts in 2025 to end as scheduled. This ensures the economy continues its steady performance for the next three decades, as it avoids recessions, wars and any other challenges the world may throw at us.

In these circumstances, the national credit will be It is not enough. By the middle of the century, it will be double the size of all the U.S. economies.

The last two years taught us something: crises can strike without warning. The federal government was already more than $23 trillion in debt in early 2020, but it has borrowed about $6 trillion more since then—much of it to fund pandemic-era stimulus bills. Pandemic-era debt isn’t the main cause of the debt tsunami that’s threatening to wash over the government in the next few decades—Social Security, Medicare, Medicaid, and decades of spending more than the government takes in are the real culprits—but so much borrowing in so short a period of time has heightened the stakes.

It’s also creating additional complications.

Inflation is running at its highest level in 40 years. The Federal Reserve stated that they will be considering raising interest rates soon. This is standard-issue macroeconomics and basic monetary policy. However, America’s debt makes the move more difficult as higher interest rates could have a reverberating effect on the government’s debt.

Brian Riedl is a Senior Fellow at The Manhattan Institute, and was a Senate Budget Staffer. He says that fiscal policy “has hamstrung” the Federal Reserve. The irresponsible Congress means that the Federal Reserve cannot perform macroeconomic stability. This will make it difficult for the Federal Reserve’s ability to provide basic economic stabilization.

Riedl has released a report that outlines both the fiscal and monetary traps facing central bankers and federal policy makers. The bottom line is that rising interest rates will increase the nation’s debt. And the already-huge national debt makes it more difficult to combat inflation—inflation that has been triggered, at least in part, by debt-financed spending.

Although the total debt amount is an important factor, it’s not the only thing that matters. The most important aspect of this equation is how much federal government pays each year in interest payments. Bruce Yandle is an economist from the Mercatus Center. He also explained this in the current issue. ReasonThe combination of falling interest rate and low inflation enabled the government to accumulate debt while not having to pay higher annual expenses for most of the 20th century. “The interest cost of the national debt in 2008 was $253 billion and remained at about that level through 2015,” he writes, even though the overall amount of debt doubled in those years.

A decade of low inflation combined with low interest rates has taught politicians there is no reason for borrowing to be restricted. While the risk of long-term massive debt existed, politicians were able to ignore it.

It is unlikely that this will be the case any longer. The annual costs of servicing federal debt will rise just like a high interest credit card that is harder to pay than a low-interest auto loan. Even if Congress didn’t authorize another penny of borrowing—it’s OK to laugh—annual payments on the debt will grow if interest rates rise.

Because every dollar used to finance the debt is one that cannot be spent elsewhere, Congress will have to make one of these two choices. Either it will have cut other areas of the budget in order to finance growing debt payments or, more likely, it will have the economic engine drain additional revenue through the use of higher taxes.

But wait, there’s more. Reidl claims that the federal government’s debt can be particularly vulnerable to rising interest rates because it has very little locked in long-term rates. Rising interest rates shouldn’t be a problem if you have a fixed rate 30-year mortgage. However, the Federal Government overwhelmingly relies upon short-term debt with an average maturity period of just 69 month.

Riedl says that “if interest rates rise in any future point, the whole national debt will rollover into higher interest rates” fairly quickly. Reason.

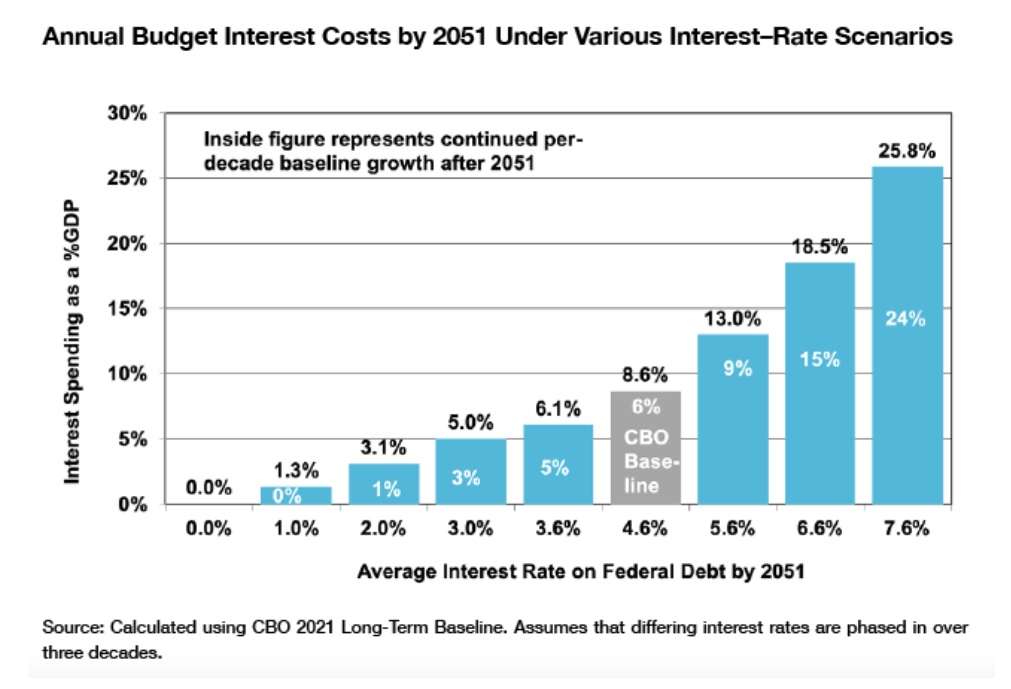

The Congressional Budget Office’s (CBO) long-term budget outlook, which serves as a baseline for projections regarding future debt costs and other budgetary matters, assumes that interest on the national debt will rise to 8.6 percent of gross domestic product (GDP) by 2051—that’s about $1.9 trillion in today’s dollars. That’s the rosy scenario I described at the beginning—a future where there are no unexpected borrowing splurges and no massive economic disruptions. This scenario still means that interest payments on the debt will consume approximately half of projected tax revenue and make up the largest part of the federal budget.

How will interest rates change if they exceed CBO’s forecast? One percentage point of interest rate increase equals a $30 trillion rise in interest costs. It’s about the same as what the country will spend on its military in the same period. The interest cost of this would consume 13% of the country’s GDP in 2051. This is approximately 70% of total projected tax revenue for that year.

Reidl calculated that interest rates on debt should be at least two percentage points higher than the CBO baseline. This would result in interest costs equal to 100% of 2051’s tax revenue. According to the current tax code, each dollar of tax revenue will be used for paying interest on money that has been borrowed and expended. This means that there would be no money left for military programs or entitlements.

Riedl states that even small interest rate movements could have a significant impact on the financial health of the country.

The Federal Reserve has to consider these enormous costs before raising interest rates. It’s not intended that this is the Federal Reserve’s responsibility, but Congress has spent years causing fiscal problems the Federal Reserve is unable to resolve.

Although central bankers might decide it is better to allow inflation to run its course rather than risk causing a crisis of debt, that decision could have devastating consequences. The price of goods will rise, wages will fall, and those who try to save for retirement can expect their savings to be wiped out by inflation.

Too long the federal government’s policy towards the national debt has been dictated by the notion that there would be no good times. Falling interest rates and low inflation may have led politicians to believe they were secure. Poor budgeting made the national balance sheet more vulnerable to an impending crisis.