The COVID-19 lockdowns have eased. Inflation rose in many parts of developed countries as pent-up demand for services and goods collided with continuing supply chain chaos.

However, inflation in the United States is much higher than elsewhere right now. Why’s that? Four economists from the Federal Reserve of San Francisco have released a paper explaining why this is. They claim that the American government was more generous in the aftermath of the pandemic. The US borrowed and spent trillions of dollars during that time to fund COVID-19 relief efforts. In addition, the direct payments to the Americans he increased the money supply and overheated their economy also helped.

In a published analysis, economists wrote that inflation rates in the United States have historically closely followed each other. Inflation in the United States has surpassed inflation in many other countries over the past half-century. According to estimates, fiscal support measures to combat the effects of the economic pandemic may have played a role in this divergence.

Annualized inflation in the United States reached 7.9 per cent in February. The Bureau for Labor Statistics is expected to release data for March next week. It was a forty-year record. The Organization for Economic Cooperation and Development data (OECD), a collection of 38 rich-world nations, shows that inflation is much lower in countries similar to France (3.6%), Germany (5.1%), and the United Kingdom (5.5%). (Across the OECD as a whole, the average annual inflation rate is about the same as the U.S., but that’s due to the influence of outliers like Argentina—where prices are up over 52 percent in the past 12 months.)

The global price data for February are more than a snapshot. They indicate a disturbing trend. In November last year, the Pew Research Center observed that American prices were increasing faster than any other country. Between the third quarter of 2019 (the last full economic quarter before COVID-19 was first identified) and the third quarter of 2021, the U.S. inflation rate climbed by 3.58 percentage points—a larger change than in all but two other countries of the 46 nations included in the study.

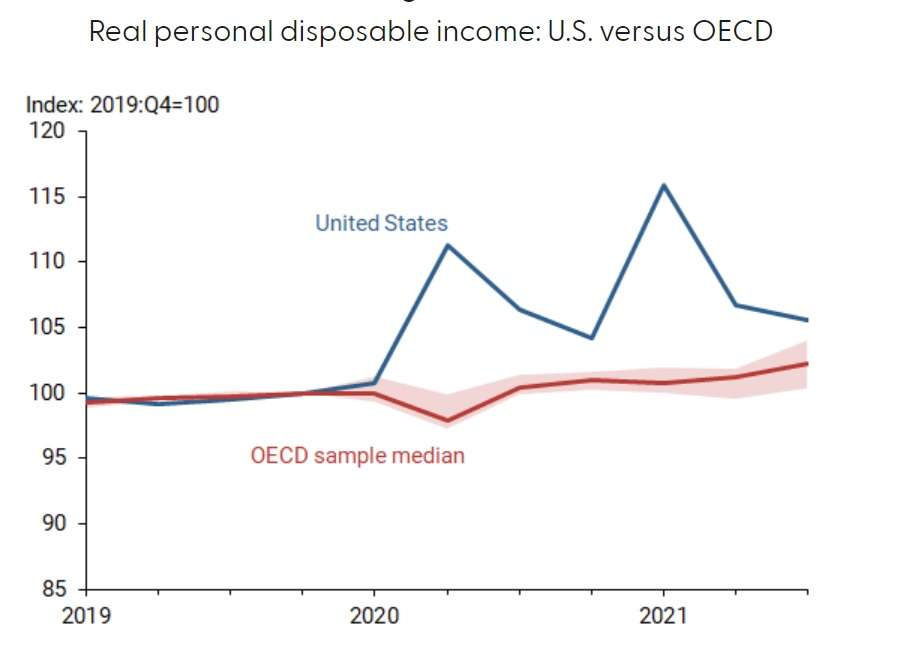

While governments around the globe spent much to fight the pandemic of the flu, few gave cash to the citizens like the American government. The four Federal Reserve researchers track sharp increases in “inflation-adjusted disposable personal income”—in layman’s terms, excess spending cash—reported by American households over the past two years. They write that U.S. households saw a significant increase in disposable income between 2020 and 2021 compared to other OECD countries.

The COVID Money Tracker of the Committee for a Responsible Federal Budget shows that $817 billion worth in direct payments was made to American households in just three rounds. This is according to a non-profit organization advocating for lower deficits. First round of stimulus payments was worth $1,200 for each person and was part of the Coronavirus Aid, Relief and Economic Security Act of March 2020. In December 2018, another round of $600 checks were distributed.

The COVID Money Tracker of the Committee for a Responsible Federal Budget shows that $817 billion worth in direct payments was made to American households in just three rounds. This is according to a non-profit organization advocating for lower deficits. First round of stimulus payments was worth $1,200 for each person and was part of the Coronavirus Aid, Relief and Economic Security Act of March 2020. In December 2018, another round of $600 checks were distributed.

However, the biggest blow was in 2021 when Biden’s administration introduced a series of $1,400 checks in the American Recovery Plan. This plan, which Congress passed in March 2021, proved to be a major victory.

Although each round of direct payments had different criteria for who got the checks, a large portion of the $817 billion went to people well over the poverty line. Households earning as much as $160,000 in joint income were eligible for the final round of direct payments disbursed during the first half of 2021—and many progressives in Congress thought the cutoff should have been even higher.

What Congress sows is now being reaped. All of that extra cash is now chasing the exact same quantity of goods. This is a recipe to inflation straight from an economics textbook. These economists concluded that the U.S. income transferred may have led to inflation rising by about 3 percent in the fourth quarter.

It’s not an original idea. Larry Summers (one of Obama’s top economist advisers) warned more than one year ago about the dangers of rising inflation. Summers was critical of the passage of another stimulus bill for spring 2021. Washington Post“Will set off inflationary pressures that we haven’t seen in a generation,” op-ed. The International Monetary Fund’s former Chairman, among others, are also top economists. offered similar warnings. The Biden Administration and Democrats in Congress didn’t listen and we now find ourselves here.

This Federal Reserve analysis has the advantage of not looking forward and trying to predict what will happen. Instead, it reviews current data to determine what. It did. The inflation rate was worse because Americans put more money into their bank accounts and pockets than they would normally.

The economists admit that an ineffective response to the pandemic could have led to a different type of economic pain. They write that without these spending measures, the economy could have fallen into deflation or slower growth. This would be more difficult to control.

Any serious attempt to grapple with America’s current bout of inflation must be aware of that possible alternate reality—the grass is not necessarily greener on the other side.

But that doesn’t absolve the federal government—from the White House to Congress to the Federal Reserve—of its role in worsening this mess. All of the world is experiencing high inflation. But American policy makers have contributed a unique amount of fuel.