Here’s a novel idea: if the government engages in less taxing, spending, and borrowing, the negative consequences of all that taxing, spending, and borrowing will be limited.

That’s the bottom line from a pair of recent studies that project the long-term economic consequences of the proposed $3.5 trillion reconciliation bill and a more hypothetical $1.5 trillion spending plan offered by Sen. Joe Manchin (D-W.Va). Manchin, who remains a key holdout in Democrats’ plans to pass the larger package through Congress, says he won’t support the $3.5 trillion bill because he’s concerned that adding to the national debt will constrain America’s future economic growth. The two studies, both completed by the Penn Wharton Budget Model (PWBM), an economic policy think tank housed at the University of Pennsylvania, support Manchin’s caution is warranted.

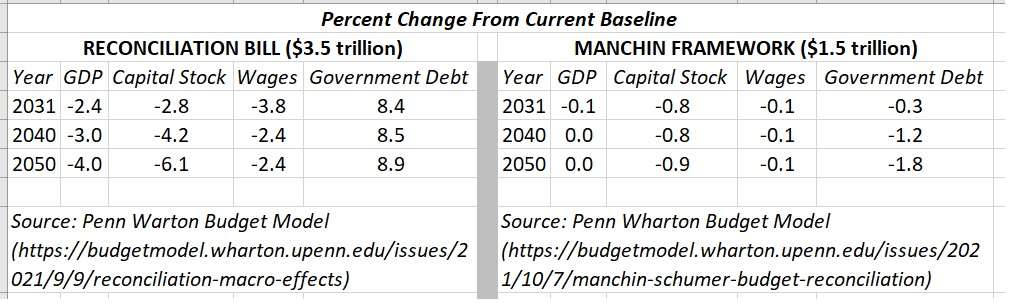

As I wrote last month, when the PWBM published its analysis of the reconciliation bill, the $3.5 trillion spending package will leave America poorer in the long run. The PWBM analysis projects a decrease in private wealth, wages, and America’s gross domestic product (GDP) over the next three decades relative to a projection in which the bill is not passed. The larger spending package would increase government debt at a faster rate, which would increase the amount the government has to pay in interest. In the $3.5 trillion scenario, higher levels of spending and higher amounts of government debt “crowds out investment in productive private capital. Less private capital leads to lower wages as workers become less well-equipped to do their jobs effectively,” the report states.

Now, the PWBM has completed an analysis of the $1.5 trillion framework that Manchin reportedly offered as an alternative. In order to do the estimate, PWBM analysts assumed that Manchin’s proposal would increase spending by about $540 billion for means-tested childcare programs, like universal pre-K; $439 billion for a five-year extension of the expanded Child Tax Credit; $260 billion for public infrastructure; and $260 billion for other assorted government spending.

That’s still a lot of money, and there are still some negative long-term consequences—but the most important part of Manchin’s proposal is that it does not require additional borrowing, and relies on smaller tax increases than what President Joe Biden has proposed. As a result, government debt would actually fall slightly over the next 30 years. The tax increases would reduce private capital by less than 1 percent by 2050—as opposed to the 6.1 percent drop that would come with the passage of the larger reconciliation package. Wages and national GDP would remain flat under the $1.5 trillion plan, instead of the projected decline under the $3.5 trillion plan.

What the report essentially says is that Manchin’s proposal would be less bad than the $3.5 trillion proposal. But it would still be a progressive scheme to redistribute wealth. “We estimate that the average 30-year-old in the lowest 20 percent income group is about $3,200 better off under the Manchin memo,” the PWBM analysts conclude. “In contrast, the average 30-year-old in the top 20 percent of income distribution is about $6,800 worse off.”

But, by limiting how much new taxing and borrowing is necessary to finance all that redistribution, Manchin’s proposal limits the damage done to the wider economy “as productivity effects of the new spending offset the distortions produced by higher taxes,” the PWBM concludes.

It is a little bit crazy that everyone in Washington is talking about $1.5 trillion as a small sum of money. What Manchin is willing to support would cost about $500 billion more than the Obama stimulus, even after adjusting for inflation. And this isn’t an emergency spending plan meant to float the country through a recession—it’s a massive increase in government spending at a time when the economy is growing significantly (despite the weirdness in labor markets and supply chains).

The potential costs of an even bigger spending plan should be front and center in lawmakers’ minds. Higher levels of debt—even if it doesn’t cause runaway inflation and even if higher interest rates don’t trigger a major crisis—will be a major drag on future economic growth.

What Manchin is proposing is a still-risky but ultimately safer plan that still gives progressives much of what they want—higher taxes on the rich and corporations, an extension of the child tax credit, and much more redistribution of economic gains—and delivers a big political win for Biden in the form of the infrastructure package. It is in no way a win for limited government, but it’s less of a win for people who think the government can buy utopia on credit.