My previous posts criticised both the Biden Administration’s legal reasoning for President Obama’s student loan cancellation program and offered an alternate explanation. Experts believe these matters will not be heard in court because nobody will be able to bring a case challenging the debt cancellation. This may be because the Administration sees the procedural question as an ace in their hole. It doesn’t really matter how strong your legal argument is if nobody can challenge it.

Debt cancellation opponents face the real problem of how to stand. However, it does not need to be overwhelming. Three types of litigants are possible to get standing: the one or two houses of Congress and student loan servicers. Colleges that don’t accept federally-backed student loans but still compete with them.

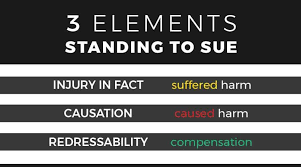

Current Supreme Court precedent states that plaintiffs need to satisfy three criteria to have standing to bring a suit in federal court.

I believe that the doctrine of standing in its entirety is not constitutionally required. The Supreme Court should eliminate it. It is highly unlikely that this will happen. Therefore, I assume that the current precedent is valid for my purposes. It doesn’t matter if it is right, the litigants must work within it.

This case presents a major problem because of the need for “injury actually”. In the Supreme Court’s sense, it may not be possible to show that student loan cancellation has caused injury. Removing student loan debt for A does not necessarily cause injury to B or C. In fact, some may argue that it would be unfair if A had to make all the payments. With rare exceptions, the current precedent demands some kind of injury. Injustice by itself isn’t sufficient.

The possibility exists that taxpayers may suffer an actual injury as loan forgiveness deprives funds from the federal treasury. This forces them to carry more of the public debt. Illegal expenditures of public money are bound to divert taxpayer resources from the authorized uses. However, the Supreme Court long rejected such taxpayer standing in any but very limited circumstances. These are not applicable here.

Taxpayers should be able to contest any illegal expenditure of public money. However, this is another area where the Supreme Court won’t be ruling my way anytime soon.

The Senate and House of Representatives have the ability to contest illegal public funding uses by the executive. Taxpayers, however, do not generally have the right to do so. The US Court of Appeals for the DC Circuit so held in a 2020 case where the Democratic-controlled House of Representatives filed a lawsuit challenging Donald Trump’s attempt to divert military funds to build his border wall (a case which has many parallels to the present situation). It was written by the prominent conservative Judge David Sentelle. His reasoning was as follows:

[T]The House seeks to correct an institutional injury that has harmed its institutional power.

Stop the spending of funds that have not been authorized. If the complaints are true and the House accepts the legality of its position, then the House will be individually and clearly hurt because the Executive Branch allegedly stripped the House of its fundamental legislative role. More specifically, by spending funds that the House refused to allow, the Executive Branch has defied an express constitutional prohibition that protects each congressional chamber’s unilateral authority to prevent expenditures….The Appropriations clause is, in a nutshell. [of Article I of the Constitution]To unlock the Treasury you need two keys. The House has one of these keys. The Executive Branch has taken the House’s key. That is the injury over which the House is suing…

The Appropriations Clause would be rewritten if it were held that the House has not been injured and that courts can’t recognize the injury. It has been long known that this Clause was intended to verify the validity of the Appropriations Clause.

power of the Executive Branch by allowing it to expend funds only as specifically authorized…

Sentelle’s argument is persuasive and applies, quite obviously, to Biden’s loan forgiveness program, not less than Trump’s border wall diversion. In this way, the Senate and the House would both have the right to sue each other, regardless of whether the Senate did or not.

As long as both houses are controlled by Democrats, neither house will likely sue. However, that may change following the November election when Republicans might retake either one of them or both (the Senate is more likely to be retaken than the House). To get standing for a suit, they can rely upon the precedent of the border wall.

The Senate and the House of Representatives would have to apply as institutions to gain standing. According to the Supreme Court, individual Congressmen do not have the standing to sue for financial issues.

Students loan servicers could be another entity that is able to sue. Student loan servicers collect payments from borrowers on the behalf of the government. The amount of fees collected depends on the amount owed and how late the borrower repays it. If loan forgiveness lowers default rates, allows some borrowers repay more quickly, or affects how much servicing companies get paid, then they would be able to sue. Fordham law professor Jed Shugerman reached the exact same conclusion.

Because they aren’t looking to upset the federal Department of Education, it is possible that loan servicers won’t be afraid of suing. For their profitability to continue, it may be important that they have a strong relationship with the federal government. However, if there is any doubt about it These areIf you are willing to sue for damages, it shouldn’t present a problem. A single plaintiff will suffice to bring the matter before the court. One loan servicer may choose to take on the risk, even though most prefer to avoid it. You could even join together to sue the Department of Education jointly. This would make it difficult for them to take retaliation against the Department of Education, which may seem reluctant to do so.

Colleges which refuse to accept federal funds (including student loans) are the last group of plaintiffs eligible for standing. They are mostly conservative-leaning and refuse federal funding because they don’t want to be bound by the regulations. Hillsdale College is one example. Loan cancellation is a way for colleges to be more attractive than those who do not accept federal student loans. Students find the latter to be a more affordable option.

The concept of “competitor status” has been recognized by courts for years. It allows the plaintiff to sue in order to contest policies that increase the market share of his or her competitors. The potential competitive harm here may be minimal. Maybe only a few students are likely to forego attending Grove City College or Hillsdale as a result of Biden’s actions. Even a minor financial loss such as no damages is sufficient to be considered an “injury of fact” according to the current doctrine.

These options are not necessarily comprehensive. They’re just some of the possibilities I find most appealing. I also admit that I don’t know much about student loans. Biden may have other options for litigants that can challenge the student loan cancellation plan. These examples show that standing is not a stumbling block. Courts will most likely have to determine the legality of the policy.