The President Biden unveiled Wednesday his student loan forgiveness plan. His executive authority will allow him to cancel $20,000 worth of debt for borrowers making less than $125,000 a year.

Biden stated, “When I ran for president I committed that I would help student debt relief.” I am honoring this commitment today.”

Biden will eliminate $10,000 federally-held student loan debt from all borrowers earning less than $125,000 per year. Pell Grant recipients who are not need-based will receive $20,000. This policy could have a significant impact on 43 million Americans and will likely cost at least $300 billion. However, there is a high chance that it will be more costly than this. Ultimately, U.S. taxpayers—many of whom did not take out loans to pay for school—will be on the hook for the money. The cost is estimated to be around $1,500. per taxpayerIs $2,100.

Biden says that all Americans should be forced to pay college debts. People who have borrowed money from the government for school are not so fortunate. They’re in dire need of the generosity of U.S taxpayers to save them.

Biden stated that an entire generation has been saddled with unsustainable student debt for the chance to get at least a college education. Even if you do graduate from college, the burden could mean that you won’t have the same middle-class lifestyle that was once offered by a college degree.

It is a serious indictment against the federal student loan system. One might expect that Biden’s generous plan to forgive debts would also be followed by reforms to the system that created these inequalities. The government admits that millions of people have been scammed by its loan program. Biden wants everyone else to step in and assist them. Their financial situation is so bad, with very little chance of getting their loans repaid.

But no, Biden’s debt forgiveness plan will do nothing—absolutely nothing—to fundamentally change the incentive system that created the doom spiral in the first place. Grad-seekers may continue to borrow huge amounts to pay for useless educations. In fact, this precedent might encourage them to do so even more.

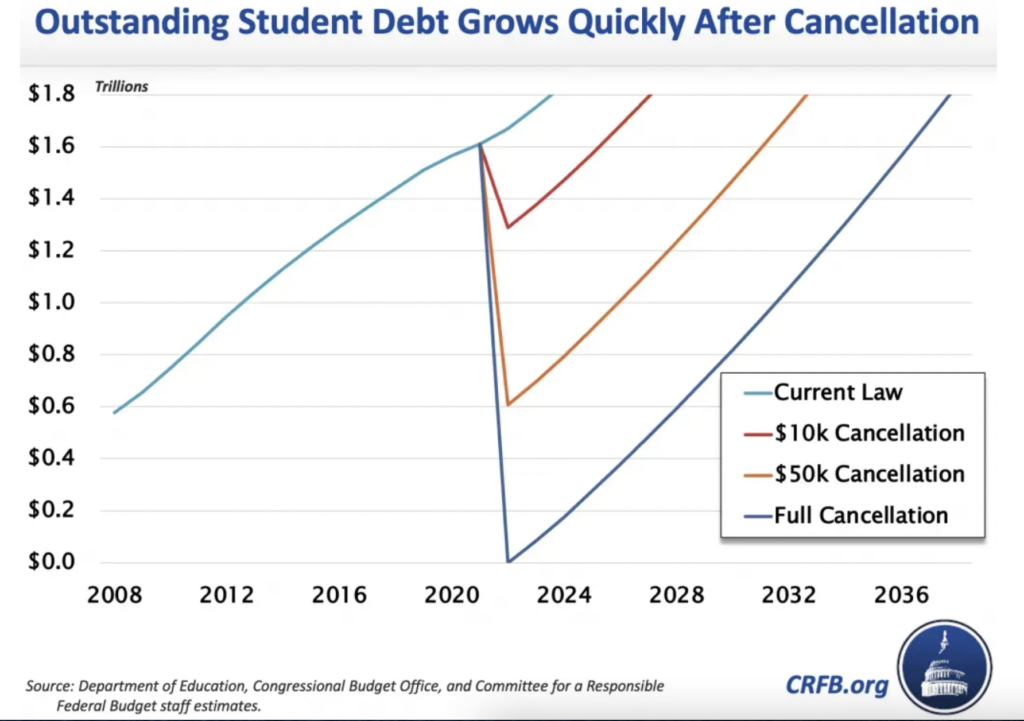

Colleges and universities are less likely to cut costs. Economists have found that universities and colleges are more likely to charge higher prices because of government-subsidized student loans. Because student loans are not forgiven, it encourages further reckless borrowing. The Committee for a Responsible Federal Budget predicts that student loan debt will rise to the current level in just a few short years.

It is possible to create structural incentives for students that encourage them to borrow money they will never repay. The fact that many have been entangled in crippling debt makes it difficult to reverse these incentives. There is no rule that the federal government can’t lure individuals down financial ruin-inducing paths. Congress has the power to limit or stop this behavior.

One-off cancellations of certain levels of debt held by people in financial distress at the moment do nothing to solve the problem. In fact, they can only make matters worse. It’s not. a slap in the faceEveryone who has paid down college debt, or chosen a different path of education to reduce it.

Biden must make it clear that he supports forgiving college loans. This action should be coupled with significant changes in the higher education system. He is just transferring wealth and taking money from people who have earned it. NotFall prey to the scam of federal government and give it to those that did.