Vladimir Putin’s invading of Ukraine is creating havoc on the markets, especially those for oil and natural gases. Russia is responsible for around 10 percent of the world’s oil production, and exports slightly more than 5million barrels per day. The European Union imports about 2,000,000 barrels per day, mainly via tankers. 40 percent of European natural resources are supplied by Russia. The majority of Russian natural gas, and much of the oil exported by Russia transit through pipelines that run through Ukraine.

They could also be destroyed or diverted by fighting. In response to Putin’s war, oil prices and gas have increased from $69/barrel in December to almost $100 now. After the invasion, European natural gases prices rose by 62 per cent, averaging about 10 times the U.S. median price.

The global oil industry has been whipsawed by the COVID-19 pandemic, which cut global demand by one-third in 2020 followed by the steeper-than-expected recovery of demand as the world (hopefully) exits the pandemic. In April 2020, oil prices dipped briefly below $20 per barrel but had risen to their pre-pandemic levels by the end of last year.

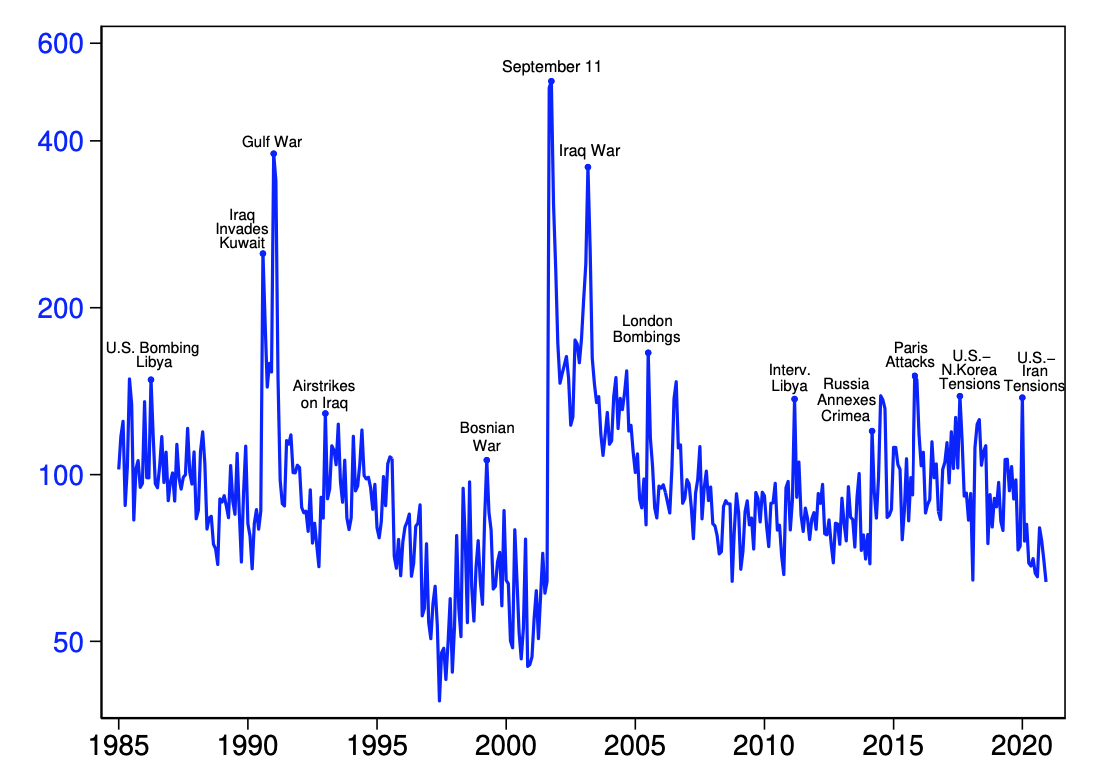

Analysts note that oil prices at $100 per barrel are near 2014’s highs. Why have oil prices risen so much seven years ago, according to commentators. Putin began proxy wars against eastern Ukrainian provinces Donetsk & Luhansk early 2014. He also invaded Ukraine’s Crimean Peninsula and stolethily annexed it. Here is an example chart that was derived from the U.S. Federal Reserve economists Dario Kaldara and Matteo Iacoviello’s geopolitical risks index.

It is comparable to the chart that tracks the changes in the inflation adjusted global oil price. The price of oil reached a peak in nominal terms at $100/barrel ($120 inflation adjusted) and gasoline was at $3.69 (inflation-adjusted at $4.36) per gallon. Current average oil price is $3.54 per gallon.

In 2014, there was an abrupt drop in oil prices. In January 2015 the nominal price for oil was $44.74/barrel (53.39 inflation-adjusted), and $2.12/gallon (2.52 inflation-adjusted).

While it’s difficult to predict the trends in petroleum prices, there is a chance that such a drop could occur again. Because the sanctions imposed by Biden aren’t targeting Russia’s natural gas or oil exports, it is possible that Russian oil could continue to flow. In addition, an impending nuclear deal with Iran may allow that country to add 1.3 million extra barrels per day to international markets. The Energy Information Administration predicts that the U.S. will see a record-breaking increase in oil production over the coming year.

Bank of America sent a brief analysis to Merrill Lynch’s financial advisors and noted that the rise in oil prices was significant, but not enormous. The European natural gas price has risen, putting further pressure on these economies. Although we believe the shock will have a short-term impact on markets, our base argument is not conclusive.