The Consumer Price Index tracks everyday item costs. Over the past year it has risen by 6.8%, which is the highest increase in over 40 years. It is now up 51%, up 20% for beef, and up 11% for furniture.

The nightly news sounds a lot too much like a rerun. This is the ’70s showThe sitcom “Whip Inflation Now”, which Gerald Ford attempted to keep on everyone, from his running mate Bob Dole and former Beatle George Harrison.

Ford, in his 1970s days, was known more for his literal, and sometimes figuratively, stumbling rather than for any of the economic skills he had. This is especially true when it comes to inflation which rose into the double digits soon after Ford took office. Ford believed the only way to defeat inflation was to get American consumers to become bargain-hunters and browbeat corporations to keep prices low. Inflation was his “domestic enemy number One” and he declared war.

Ford promised that he would buy only products or services at or below current prices.

Joe Biden looks a lot like the 38th President, but that’s not because he has difficulty with plane steps.

Biden and his advisors as well as his supporters in the media are ignorant of the hard lessons from the past, downplaying inflation, or strangely asserting that it only affects the rich. Then there’s leading Democrats like Sen. Elizabeth Warren (D–Mass.He seemed to channel Gerald Ford during the interview. she tweeted outIt is true that Thanksgiving food costs more because of greedy corporations charging Americans extra to keep stock prices high.

Even worse, Biden and crew are delusionally pronouncing that we can tame inflation by pumping massive amounts of government money into the economy—a course of action that will almost certainly make everything more expensive. This package will lower the cost of some important items, but that is not what it does. [families]Pay for healthcare, and for child care. It is anti-inflationary. That’s what it means,” Janet Yellen from the Treasury Department said to defend the recent $1.2 trillion infrastructure bill. She also promised even bigger bills related the the “Build Back Better” president’s agenda.

What Ford, Biden, Warren, and Yellen have in common is a failure to understand inflation’s most important underlying cause, which the Nobel Prize–winning economist Milton Friedman was explaining with unique clarity back in the 1970s. “To understandFriedman stated that inflation is caused by monetary phenomena. While supply-chain problems and increasing demand can also be factors, the Federal Reserve and government are the main contributors.

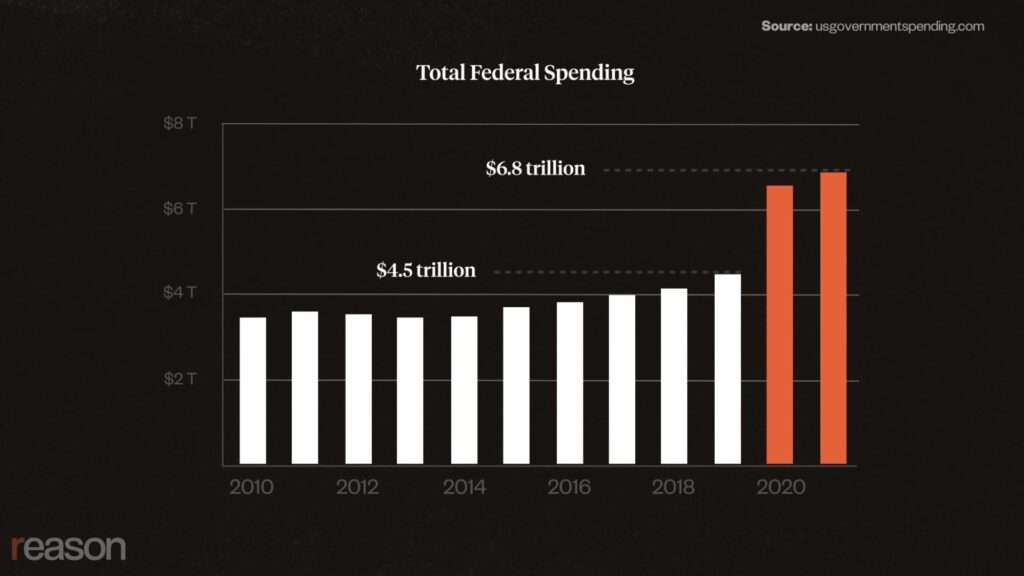

Over the last two years we have seen huge increases in government spending. These were paid for with printing money and historical boosts to the money supply. Printing money means there is more money to buy the exact same amount of goods or services. This causes prices rise. The federal budget has grown to almost $7 trillion annually in just three years. That’s an increase of $4.4 trillion from fiscal year 2019, which was about $4.4 trillion. In 2020 spending was $6.6 trillion, while it reached $6.8 trillion by 2021.

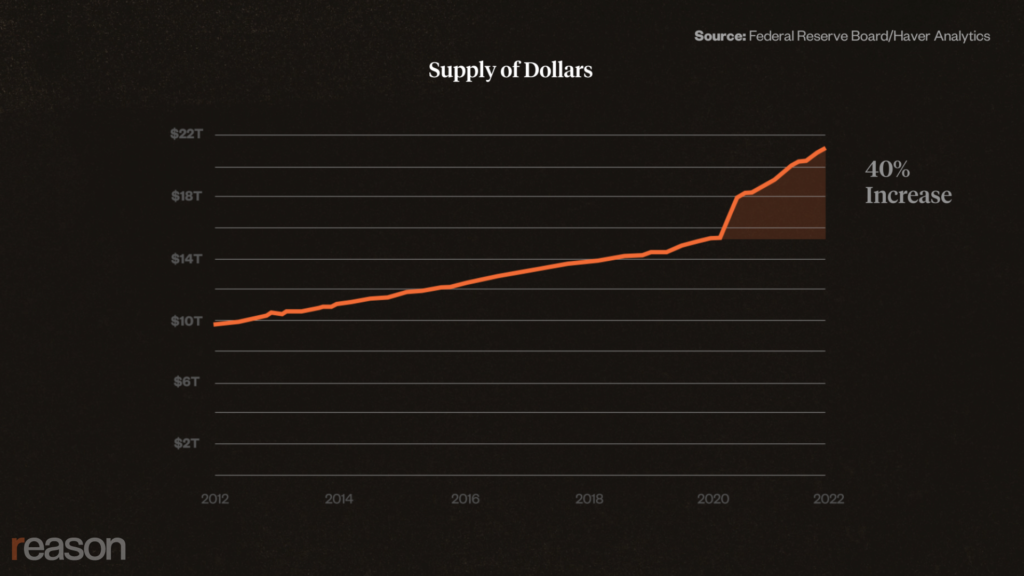

Between March 2020 and November 2021, the Fed created more money to purchase that debt while the government borrowed more. The end result? A nearly doubling of the dollar supply. 40 percent over the past 2 yearsThis is an off the charts record.

Inflation can be controlled by increasing interest rates and limiting the flow of money through tax increases or spending cuts. This is the only way that has worked so far, unless we go into recession. There is no evidence that Biden, or any other Washington official, are committed to the kind of fiscal and monetary discipline that will tame inflation. The president’s bill for infrastructure increases the amount of entitlement spending, which is the main driver of long-term spending. He’s not just trying to improve access to and provide coverage for existing programs, such as Medicare or Medicaid; he is also pushing tax credits for parents along with new entitlements for universal preschool and child care.

The public-held debt has increased in share of GDP by more than quintupling over the past forty years. In 2022, the Congressional Budget Office predicts that interest payments on the debt will be 5.7 percent of total spending, more than doubling to 11.6 percent by 2031. That’s all assuming that interest rates are low. This is not the most popular political strategy. It’s impossible to squeeze out inflation by raising interest rates. It will make it even more difficult to do so now, as it will completely destroy the government’s financial position.

Friedman compared the initial stages of inflation with alcoholism in the 1970s. As their salaries rise, politicians are allowed to spend more and tax revenue increases without having to pass new legislation. Some consumers also feel they’re gaining buying power. He warned that inflation is similar to alcoholism. Both cases are similar in that the positive effects of drinking and printing excessive amounts of money come first. The negative effects follow later. In both instances, there is a temptation to consume too much alcohol and print too many dollars.

Let me add one more insult. The price of alcohol is rising, which means that we will have more problems and it will cost more for us to drown them.

Nick Gillespie produced the video; Adani Samat did the graphics and video editing; Ian Keyser mixed it.

Video: Excerpts from Milton Friedman Speaks: Money and Inflation (1978) and Free to Choose (198) courtesy of Free to Choose Network.

Music: Grey Shadow, ANBR, and Temptation by Ride Free licensed via Artlist