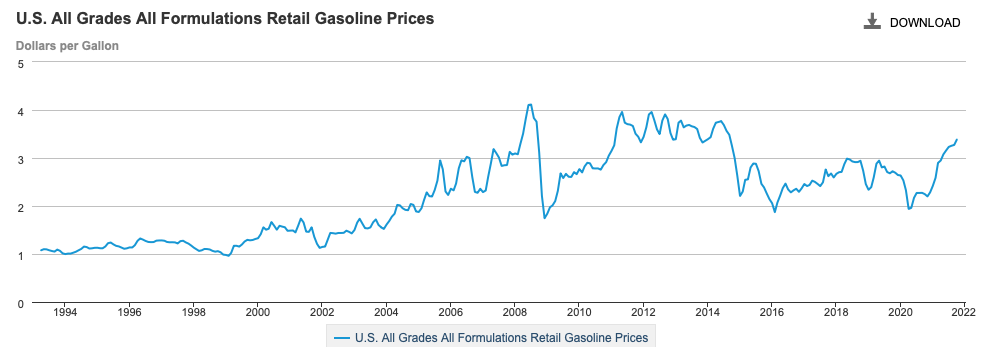

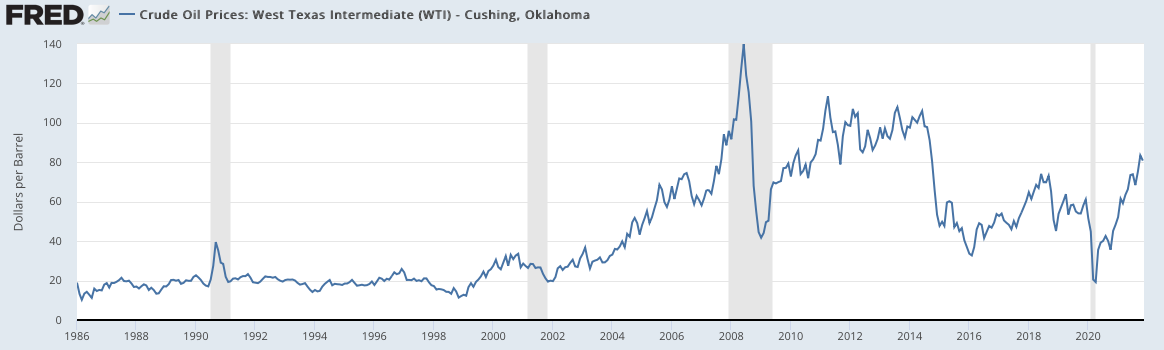

Pretending to do something about rising gas prices, Joe Biden plays political theatre. To help curb the rise in gasoline prices, Biden made an announcement earlier today that 50 million barrels will be released from the country’s strategic petroleum reserves. Prices for oil fell to about $20 per barrel in the wake of the COVID-19 pandemic. But prices rose to almost $80 per barrel as world economies rebounded. Accordingly, the average gasoline price per gallon has increased from $2.11 in a year to $3.40 today.

Biden and his allies, such as Sen. Elizabeth Warren (D–Mass.The rising price of oil has been blamed by Biden and his Allies (Sen. Elizabeth Warren, D-Mass. Biden requested that the Federal Trade Commission Chair Lina Khan investigate oil companies’ “anti-competitive and potentially illegal behavior” in a last week letter. In 2011, the Obama administration used political theatre to demand an FTC investigation after gasoline prices rose dramatically, reaching nearly $4.00 per gallon. Shocking news: In its September 2011 report, the FTC concluded that gasoline prices were driven by crude oil prices. Since 2005, crude oil prices have fluctuated due to changes in supply and demand. This conclusion is confirmed by a comparison of U.S. gasoline prices with global oil prices. This means that Big Oil is not responsible for the rising prices of gasoline.

During much of 2011, petroleum prices were between $115 to $80 per barrel

Biden, in August 2021, asked Saudi Arabia (OPEC+), and other Organization of Petroleum Exporting Countries (OPEC+), to continue pumping crude oil.

The president could have made it even better if he had encouraged American oil companies more to make their own products. “The Administration is blaming others when it ought to take a sober look at its own energy policy,” observed Derrick Morgan, vice president of American Fuel & Petrochemical Manufacturers, a trade organization. Morgan noted that prices can only be determined by firms competing in an environment of demand and supply. Unfortunately, federal policy has been disincentive to supply. They have shut down pipelines, put future production on hold, talked down the future petroleum business and imposed costly requirements on refineries. The most burdensome being a Renewable Fuel Standard.

Biden’s administration cancelled the approval for Keystone earlier in the year, and could or might not consider closing down Line 5 the vital pipeline through Michigan. Biden’s administration had stopped new leases being issued for oil-and gas drilling on federal lands, waters and in January. But, it has now reversed course and is now allowing new oil-and gas exploration. Biden certainly has been “talking down” fossil fuels, such as oil or gas, because he is concerned about man-made global climate change. Refiners must add ethanol to gasoline to meet the 2005 renewable fuel standard. This can increase gasoline prices by up to 30 cents. Both the Trump and Biden administrations—in thrall to midwestern biofuel states—strongly supported the renewable fuel standard.

The fracking revolution had made the United States the largest oil producer in the world. It went from being an importer with nearly 13,000,000 barrels per day back in 2005, to exporting approximately 1 million barrels each day by 2020. The U.S. was the main price-setting agent for global oil markets over the last few years. The initial economic downturn caused by the pandemic led to oil prices plummeting and U.S. oil companies operating at 250 rigs was the lowest ever recorded.

Two loathsome regimes have been able to set the world’s current price for petroleum by allowing the U.S. to slow down its oil production recovery. One that slays journalists, and the other that poisons dissidents. However, the pricing power wielded by OPEC+ may not last too much longer since the good news is that the number of oil rigs drilling in the U.S. is rising and reached 563 this past week.